Med Spa Insurance: What It Is & How to Get It

By Dr. Stephen Cosentino

PRESIDENT OF EMPIRE MEDICAL TRAINING

Like any business, your medical spa’s continued success depends on thorough risk management.

Insurance is a critical piece of the risk management puzzle. Without adequate medical spa insurance, your practice could be vulnerable to patient and vendor lawsuits that damage its reputation and drain its coffers.

What Is Med Spa Insurance?

Medical spa insurance, or med spa insurance, is a special variety of professional liability insurance designed for medical spas and medical aesthetic practices.

Types of Medical Spa Insurance & What They Cover

The core of any med spa insurance policy is medical spa malpractice coverage that defrays the cost of medical malpractice lawsuits.

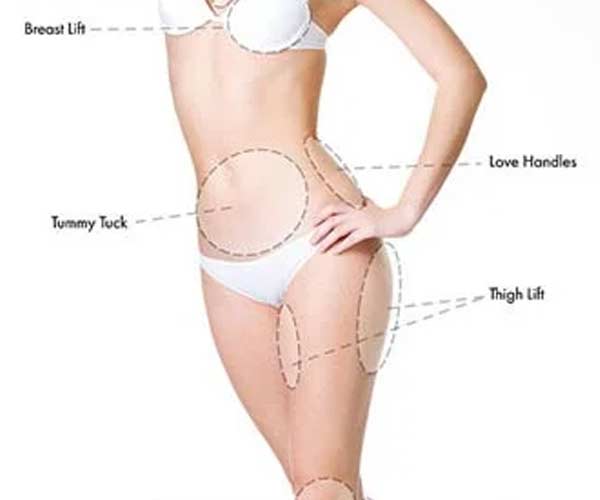

Med spa policies can be customized to the needs of the insured practice, but “standard” policies generally provide coverage for liability related to aesthetic and medical procedures like:

- Botox injections

- Dermal filler injections

- Chemical peels

- Laser therapy and IPL treatment

- Anti-aging hormone treatments

- Medical weight loss

- Alternative medicine treatments like platelet rich plasma (PRP) and IV therapies

Many aesthetic practices purchase med spa insurance in conjunction with other types of business insurance, such as general liability or a business owner’s policy (BOP) — which combines general liability and commercial property coverage.

How Much Does Medical Spa Coverage Cost?

A basic med spa insurance policy with few add-ons should cost between $2,500 to $5,000 per year, per $1 million claim limit of liability. In other words, a $1 million policy should cost between $2,500 and $5,000 per year; a $5 million policy should cost between $12,500 and $25,000 per year.

The actual cost of med spa insurance coverage depends on several factors:

- The size of the policy as measured by claim limit of liability

- The level of coverage — for example, whether the practice requires physician coverage for healthcare professionals providing direct patient care

- The types of procedures performed at the practice

- Practice revenue, which may affect liability and claim value

- Additional coverage added to the policy, such as workers’ compensation or general liability insurance

Where to Get Medical Spa Insurance

If you already work with an insurance agency for your business insurance needs, ask your agent about medical professional liability coverage for your practice.

Just don’t be surprised if they don’t have a med spa policy at the ready. This is a fairly specialized type of insurance, after all.

If your agent can’t help you directly, look for specialized agencies that do offer med spa policies, like the Wellness Medical Protection Group. Your chosen agency should:

- Provide comprehensive medical malpractice insurance

- Cover your medical director and all medical professionals working under them

- Cover aesthetic, anti-aging, and alternative treatments, such as Botox and dermal filler injections, hormone therapy, IV therapy, PRP therapy, plastic surgery and medical weight loss treatments

- Provide coverage for sexual harassment claims, HIPAA privacy breach claims, and medical negligence claims

- Offer customized coverage levels and packages tailored to your practice’s needs

- Provide coverage across all of your practice geographies

Your aesthetic practice is too important to leave exposed to patient and vendor claims. Invest in med spa insurance today — before it’s too late.